CSRD, CSDDD and ESRS - key things to know in 2025.

In 2019, the European Commission launched the European Green Deal, charting a course for Europe to become the world's first climate-neutral continent. Central to this mission is fostering a green economy, directing investments towards sustainable ventures.

Legislative acts like the EU Taxonomy and the Corporate Sustainability Reporting Directive (CSRD) are pivotal in advancing this agenda. The EU Taxonomy sets clear criteria for activities to qualify as "sustainable," empowering investors to align with green goals.

Meanwhile, the CSRD replaces the Non-Financial Reporting Directive (NFRD), ushering in comprehensive Environmental, Social, and Governance (ESG) reporting requirements. By standardizing reporting and enhancing transparency, the CSRD propels Europe towards a more sustainable future.

1. What are CSRD and ESRS?

The CSRD, in effect since January 2023, mandates annual sustainability reporting for companies within the European Union. European Sustainability Reporting Standards (ESRS), endorsed in July 2023, delineate specific reporting requirements, facilitating comprehensive sustainability assessment.

The CSRD requires that companies transparently report their sustainability performance annually, replacing the prior Non-Financial Reporting Directive (NFRD). The CSRD expands sustainability reporting requirements, increasing the number of covered companies from approximately 11,700 under the previous Non-Financial Reporting Directive (NFRD) to around 50,000. This includes certain non-EU companies operating in the EU, ensuring greater transparency on environmental, social, and governance (ESG) matters.

Additionally, the European Commission approved the European Sustainability Reporting Standards (ESRS) in July 2023. These standards specify reporting requirements for each topic, facilitating improved comparison and monitoring of sustainability performance across companies.

2. Who does the CSRD apply to?

Many companies face uncertainty regarding CSRD compliance timelines, risking reputational damage and sanctions for non-compliance. Here's a simplified timeline:

By 2025: Companies under NFRD regulations report on 2024 sustainability performance if meeting at least two of the following criteria:

> 250 employees

> 40 million Euros revenue

or > 20 million Euros total assets.

From January 2026: Large European companies report on 2025 sustainability performance if meeting at least two of the following criteria:

> 250 employees

> 50 million Euros revenue

or > 25 million Euros total assets.

From January 2026: Listed European SMEs must report on their 2025 sustainability performance if they meet at least two of the following criteria:

Balance sheet total of €4 million or above

Net turnover of €8 million or above

An average of 50 or more employees during the financial year

From January 2029: Non-European companies with at least one subsidiary or branch in Europe and >150 million Euros turnover report for the first time, covering 2028.

3. How to comply with CSRD?

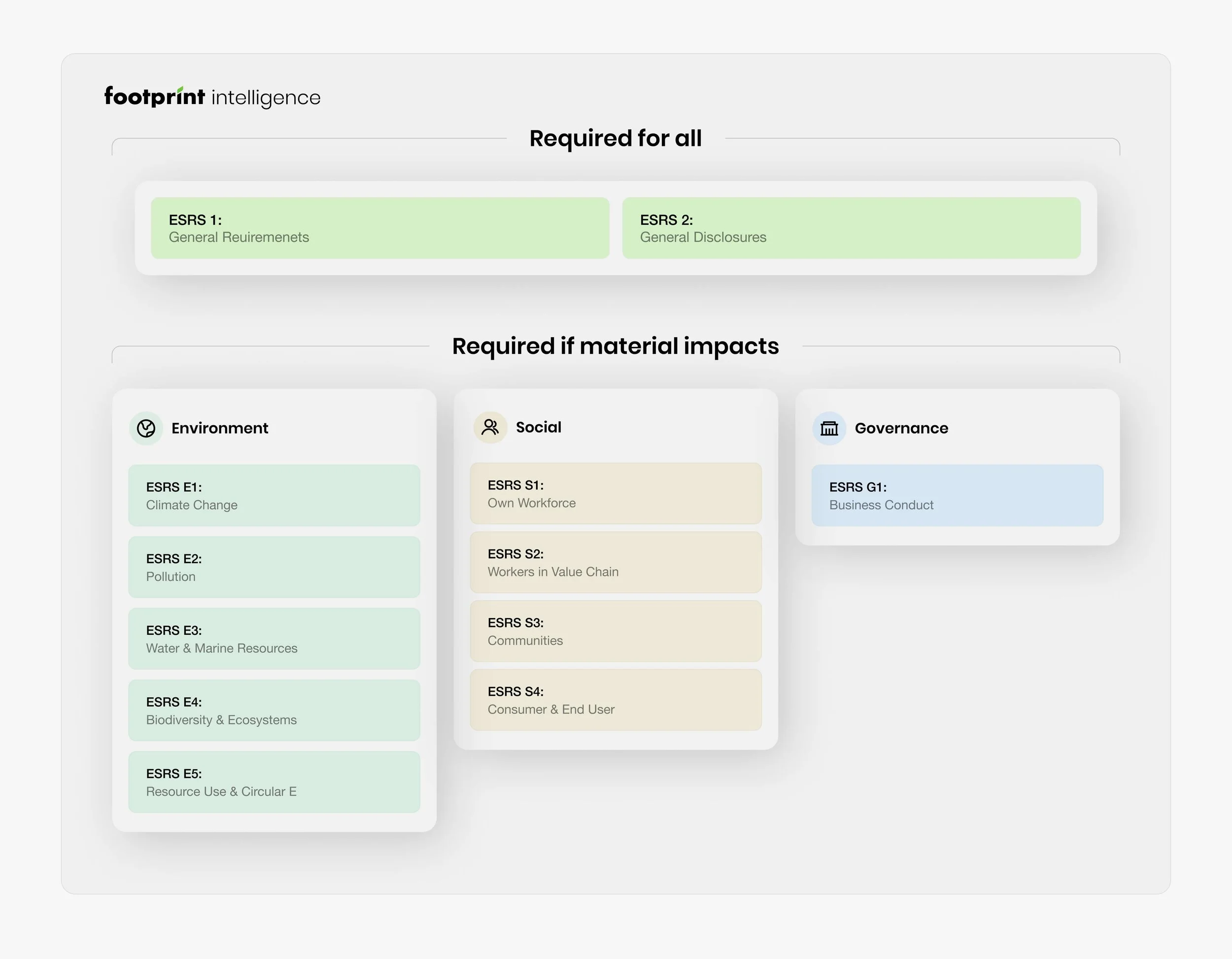

The CSRD relies on 12 European Sustainability Reporting Standards (ESRS) to define reporting criteria. These standards include two overarching standards applying universally and 10 thematic standards, currently in effect. Sector-specific and non-EU company ESRS will be introduced at a later stage, with adoption set for mid-2026. Companies should refer to the ESRS adopted in July 2023, which set the current reporting framework. Additional sector-specific and non-EU company ESRS are expected to be implemented in the coming years, with a target date in 2026.

To comply with CSRD, companies must disclose their sustainability strategy, impact, and targets, with reports verified by a neutral third-party auditor, akin to financial reporting requirements. Companies should refer to the European Sustainability Reporting Standards (ESRS) from EFRAG, providing guidance and required metrics.

ESRS 1 and ESRS 2 are mandatory for all CSRD companies, covering strategy overview, risks, policies, and targets. Other standards apply based on materiality assessment, while sector-specific requirements are slated to take effect in the following years.

4. What is a (double) materiality analysis?

A materiality analysis involves assessing which sustainability themes are pertinent to your company.

Impact materiality: Evaluates environmental or social themes influenced by the company (inside-out).

Financial materiality: Considers external sustainability-related factors impacting the company's financial status (outside-in).

The European Sustainability Reporting Standards outline criteria for determining materiality. Companies can establish a threshold for a theme to be deemed material or relevant. A theme is material if it's relevant in at least one of the two categories (impact/financial).

Footprint Intelligence offers guidance on conducting a materiality analysis, involving collaboration with your company's working group and stakeholder consultation to address diverse expectations and interests. Our newly created factsheet provides digital and media companies with comprehensive support for conducting their CSRD-compliant materiality assessment.

5. What's new in final ESRS?

Following public consultation, the European Commission adjusted the draft ESRS standards recently released. Here's a summary of the changes:

Introduction of a phased-in period of 1 or 2 years for specific reporting requirements, primarily for companies with <750 employees.

Increased flexibility in determining which themes are material for each company.

Certain reporting requirements have become voluntary.

1. The extended phase-in period applies mainly to companies with fewer than 750 employees, giving them more time to prepare.

2. Companies now have more flexibility in choosing material themes, potentially reducing costs. However, the 'General disclosures ESRS 2' standard remains mandatory for all companies. Additionally, 'Climate change ESRS E1' is subject to materiality analysis. If a company deems climate change immaterial, it must justify its decision.

3. Some reporting requirements have shifted from 'shall disclose' to 'may disclose,' particularly challenging data points such as the biodiversity transition plan and specific indicators for self-employed and temporary workers.

6. What are the steps to comply with CSRD?

Achieving CSRD compliance varies for each company, depending on factors like its business nature, phase-in schedule, and existing sustainability reporting status. Here's a summary of suggested next actions:

Define entities required for CSRD reporting, along with any needed accommodations.

Conduct a double materiality assessment to pinpoint relevant ESRS impacts, risks, and opportunities.

Address gaps between ESRS requirements and currently available information.

Collect necessary data.

Prepare for and obtain limited assurance.

7. How to optimize CSRD reporting?

On the journey to CSRD compliance, Footprint Intelligence helps companies streamline the reporting process, leveraging AI to expedite compliance. By harnessing technology, we transform this obligation into a competitive advantage, empowering companies to navigate sustainability reporting with efficiency and precision.

8. What is CSDDD?

The Corporate Sustainability Due Diligence Directive (CSDDD) is a landmark EU legislation aimed at mandating companies to conduct thorough environmental and human rights due diligence across their operations, subsidiaries, and value chains. This directive ensures that businesses not only identify and address potential risks but also actively work to prevent and mitigate negative impacts on human rights and the environment.

The Corporate Sustainability Due Diligence Directive (CSDDD) was officially adopted and entered into force on 25 July 2024 as Directive 2024/1760. This directive establishes mandatory due diligence requirements for large companies to identify and address adverse human rights and environmental impacts within their operations and value chains.

Scope and Coverage

• EU-Based Companies:

The directive applies to large EU limited liability companies and partnerships with over 1,000 employees and a net worldwide turnover exceeding EUR 450 million. It also applies to non-EU companies generating at least EUR 450 million in net turnover within the EU.

The applicability criteria have been updated. The directive now covers approximately 6,000 large EU companies and around 900 large non-EU companies meeting the revised thresholds, focusing on major corporations rather than medium-sized businesses.

• Non-EU Companies: Targets non-EU companies operating within the EU that meet the above-mentioned turnover thresholds, with the revenue being generated within the EU, regardless of whether they have a branch or subsidiary in the region.

Stakeholder Engagement

Companies must engage with affected stakeholders, including workers and local communities, as part of their due diligence.

Reporting and Transparency

Companies must publicly report their due diligence processes and measures taken to address adverse impacts.

Next Steps / Implementation

Member States must transpose the directive into national law by 26 July 2027. The rules will then apply in a staggered approach, with the first group of companies complying by 26 July 2028 and full application by 26 July 2029.

3 years (i.e., likely in 2027) for: EU companies with more than 5,000 employees and EUR 1,500 million net worldwide turnover, and non-EU companies with more than EUR 1,500 million net turnover generated in the EU.

4 years (i.e., likely in 2028) for: companies with more than 3,000 employees and EUR 900 million net worldwide turnover, and non-EU companies with more than EUR 900 million net turnover generated in the EU; and

5 years (i.e., likely in 2029) for companies with more than 1,000 employees and EUR 450 million turnover.

CSDDD & CSRD: What's the Difference?

While the Corporate Sustainability Reporting Directive (CSRD) focuses on expanding sustainability reporting, the CSDDD emphasizes the need for companies to actively engage in responsible behavior, particularly in social and environmental matters. Both aim to enhance corporate accountability and transparency, but they have different focuses and implementations:

1. Focus

CSRD: Concentrates on sustainability reporting, requiring companies to disclose their environmental, social, and governance (ESG) performance.

CSDDD: Focuses on due diligence, requiring companies to actively manage and mitigate adverse impacts on human rights and the environment.

2. Scope of Application

CSRD: Applies to a broad range of companies, including large companies and listed SMEs in the EU, and non-EU companies with significant EU operations.

CSDDD: Targets large companies, particularly those with extensive supply chains and significant impacts on human rights and the environment.

3. Requirements

CSRD: Involves annual sustainability reporting based on European Sustainability Reporting Standards (ESRS).

CSDDD: Imposes due diligence duties, requiring risk assessments, preventive measures, and reporting on due diligence activities.

4. Reporting & Action

CSRD: Focuses on disclosure and transparency.

CSDDD: Emphasizes proactive measures to address and mitigate impacts.

5. Governance

CSRD: Enhances transparency through reporting.

CSDDD: Integrates sustainability into governance, requiring directors to consider sustainability impacts in decisions.

In summary, while CSRD enhances transparency through detailed reporting, CSDDD enforces proactive due diligence to prevent and mitigate negative impacts on human rights and the environment. Both are essential to the EU's strategy for sustainable and responsible business practices.